Explained - Spanish Wealth Tax

We explore Wealth Tax in Spain with Alex Radford and Pedro San Nicolás González from our Ciudad Quesada office.

We look at:-

- Who has the obligation to declare the Spanish wealth tax?

- Do Spanish non-tax residents need to pay?

- What assets must be declared in the wealth tax?

- When and how is the declaration made?

- Is it possible to deduct any expense or debt?

- How much is paid?

- Is there any other tax that could affect my estate in Spain?

Watch the video highlights and more information in our text below:-

Who has the obligation to declare the Spanish wealth tax?

Residents: You must declare wealth tax in Spain, if the rate of this tax has a positive result and if you have a global estate of a certain value. The general value is €700,000, but the autonomous regions have the possibility of raising or lowering these limits:

- Valencian región which includes the Costa Blanca: €500,000

- Andalucia which includes Costa del Sol but has been eliminated but there is the solidarity tax.

- Murcia: **** The government has declared that it will be eliminated.

- Balearic Islands: General law applies and the tax is payable after 700,000.

- The owner has more than 5% of the company (20% family group)

- The company has economic activity

- Must have management functions and be paid by the company.

If the tax due is negative, but you own assets of more than €2,000,000, you must also make a declaration.

If I am not a tax resident in Spain, am I also obliged to declare?

Yes, but only for the assets located in Spain.

Non-resident taxpayers will have the right to apply their own regulations approved by the Autonomous Community where the greatest value of the assets and rights that they own and for which the tax is required is located, because they are located, can be exercised or have to be fulfilled in Spanish territory.

What assets must be declared in the wealth tax?

Things like real estate, bank accounts, insurance, shares**** etc.

When and how is the declaration made?

It is paid using form 714 during the income tax declaration period (between April and June).

Is it possible to deduct any expense or debt?

Debts that affects the value of the assets could be deducted such as mortgages.

Example the mortgage, but only the outstanding debt as of December 31.

The value of the habitual residence can be deducted up to a limit of €300,000

**** Shares in companies are exempt if:

How much is paid?

The tax rate is proportional to the amount of the tax base declared:

Debts, the value of the habitual residence up to €300,000 and the exempt minimum of each community are deducted from the value of the assets.

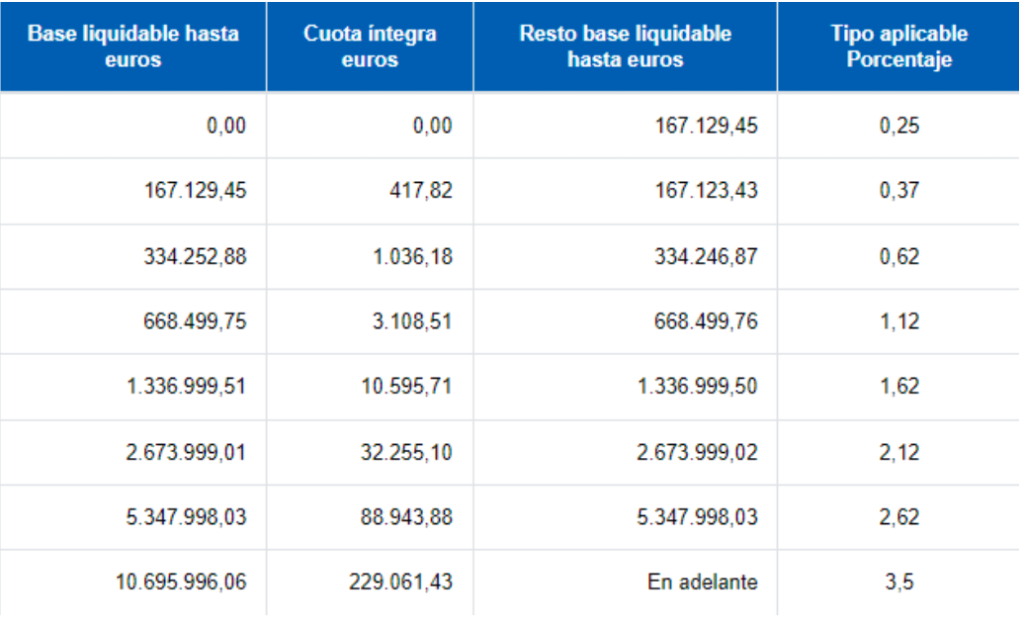

Once we have the tax base, the rate scale is applied:

i.e. Valencian Community:

Is there any other tax that could affect my estate in Spain?

The Spanish government has published recently what people has called the solidarity tax.

The tax will affect estates whose value exceed 3 million euros, applying a tax rate between 1.7% and 3.5%.

This tax would be complementary to the current wealth tax which has been collected by the Autonomous Communities. In practice, taxpayers located in the Autonomous Communities in which the Wealth Tax is very low or non-existent (For example, Andalusia or Madrid), would be the most affected by the new tax, since the Wealth Tax will be deductible in the Communities where it already exists, in order to avoid double taxation. In territories such as the Valencian Community, where the Wealth Tax is significantly higher, it is not expected to have a big impact.

This measure will affect not only tax residents in Spain but also non-residents, and probably in a worse way, as only residents could enjoy the Wealth Tax deductions.

If you need help understanding your Wealth Tax or calculating the amount due, contact us We are here to help.